Hi,

my first contact with Tryton. I used Lexware Financial Office before and made accounting (Bilanz, GuV, UstVA, Ust, Elster; as well as income tax) on my own. So I assume I have a basic understanding about the concepts. Now I will switch to simple german “EÜR” and was looking for a tool to write bills (im Europe, we have SEPA QR codes, in Germany, we need to fullfill “eRechnung” and whatnot). I find Lexware far too expensive and I neither wanted a Microsoft-dependent solution nor a (cloud) abo. So I came to Tryton!

My use case essentially I writing invoices, get UstVA data to fill ELSTER online and at the end of year get EÜR data for TAXMAN or whatver EinkSt program.

Before starting, I read quite some text and even watch two videos. Tryton seems very flexible and professional, runs on Linux, has a great web GUI and many times I read that it has a great community (that’s why I’m here :)). There even is a great book “Tryton Buch DACH”. Everything looked so promising. No long texts about customized invoice templates or mandatory fields, so I (possibly wrongly) assumed it would just work. I tried following it, but I even fail to correctly create my own company or to create an invoice.

I installed things up to SAO and followed the “wizard” and filled the forms. No new entry did not appear in the list, so I assumed I did something wrong and I tried again. Still, nothing appeared. Then I noticed the refresh button, pressed it and viola, I had my company. Twice of course ![]()

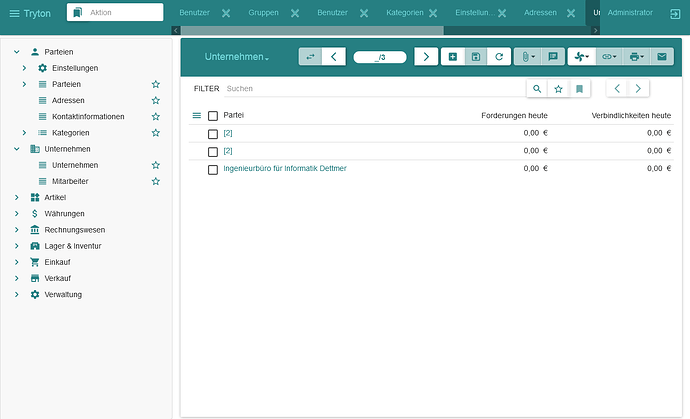

I selected the latest entry, deactivated it and deleted it. I ended up two still two entries, but now with empty content. To proceed, I created my company again assuming I could worry later. I attach a screenshot showing the deleted entry as “[2]” twice.

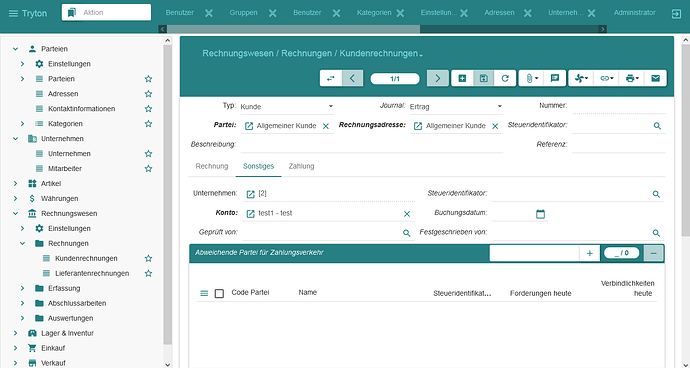

I tried to create an invoice. Beside that my SKR03 account module seems not to offer the accounts (I created something just to proceed, I even needed to add tax manually, but surely because I did not read enough yet), another issue is that I cannot change the company in the invoice, it is fixed “[2]”.

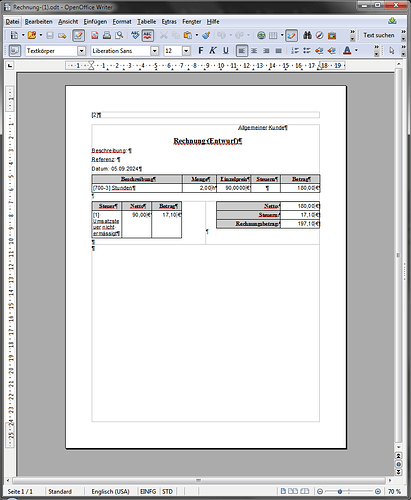

Then I tried to use the print icon. I think I had a very different expectation (a PDF with SEPA / GiroQR code and embedded eRechnung data), but I only got a “Rechnung-(1).odt”, so all I got was this:

It has no addresses, does not match window-envelope-format, does not even contain a bill number or an “Leistungsdatum” or the VAT at numeric value (I think in Germany we must print “19%” as number). As it is, for me this is useless, at least a lot of configuration seems to be needed. Unfortunately I didn’t find anything in the DACH handbook mentioned above. The “HOWTO print an invoice” texts I read didn’t help me either. Also, unfortunately, I lack the understanding of the concept behind. For example, I had to configure item groups with tax/VAT properties, similar as it is done in Lexware (with “Datev Automatikkonten”), but on the bill I had to do it manually. From the item, not even the price was taken automatically. In Lexware, the properties are taken from item groups, calculated automatically, using many configurable parameters (like logo file, size, position; fields to print…) and even some Visual Basic code that someone can adjust. This results in a PDF that can be sent by mail.

My use case essentially I writing invoices, get UstVA data to fill ELSTER online and at the end of year get EÜR data for TAXMAN or whatver EinkSt program. Can I reasonably archive this with Tryton?

Thank you for reading this long text. Any feedback, especially pointers where to read and learn, as well as rough general statements (like “you need commercial module abonements to create invoice PDFs for Germany”), is appreciated!

Best regards,

Steffen